The demand for tax-efficient investments in Portugal has surged due to the increased numbers of people retiring there. Taxation can be complex at the best of times. Cross-border taxation presents further challenges, particularly for those who own assets and investments in multiple jurisdictions.

A common misconception is that of an individual’s tax residence and the tax treatment of investment products located in countries where they no longer live.

A good example is the 25% Tax-Free Cash available to holders of UK personal pension plans on retirement. This part of a pension plan is indeed tax-free in the UK, but it doesn’t often follow that it’s also tax-free in the country in which one resides and is tax resident.

Similarly, an investment account which may attract tax benefits in a person’s home country isn’t necessarily treated the same in the country in which he/she is tax resident.

Tax optimisation

British people who move to Portugal, seeking to benefit from the non-habitual tax regime (NHR), may also hold ISAs (Individual Savings Accounts) built up while UK tax resident. ISAs are probably the best way of saving from taxed income as proceeds are paid free of income and capital gains tax. Additionally, no tax is levied along the way.

The bad news is that ISAs are taxable in Portugal annually at 28% of any gains. Because ISAs aren’t taxed in a ‘foreign country’, they, therefore, don’t count towards the NHR beneficial tax treatment.

The situation is similar for those who may have downsized their property, having sold their UK house and bought in Portugal. The equity released would be subject to Portuguese tax if invested into shares or investment funds in Portugal or any other country which doesn’t tax investments at source.

The good news is there is an answer to this dilemma. No one wants to pay more tax than is required by law. Portuguese tax residents can choose to pay at the ‘arising’ basis above or defer tax to a later time at much lower rates.

Tax-efficient investment in Portugal using a Life Insurance Bond

Income from a qualifying life insurance bond in Portugal is subject to Personal Income Tax but taxation is postponed until partial or total surrender.

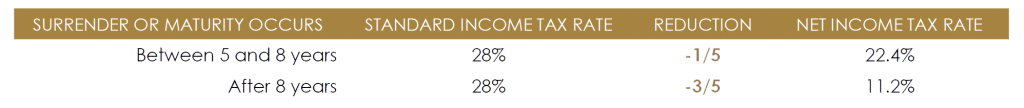

As long as the policy is not surrendered, there is no taxation on capital. In the case of total or partial surrender, the proportional capital gain is subject to Personal Income Tax, with the following reductions:

Ideally, the Portuguese Life Insurance Bond should be held for at least eight years to fully benefit from the favourable tax treatment.

It should also be noted that insurance payments to one or more beneficiaries different from the policyholder are not subject to taxation in Portugal on capital gains.

Let’s take a look at an example:

Peter and Jane decided to move to Portugal, selling their house and realising £600,000 in equity due to downsizing. They also own ISAs with a value of £400,000.

If we assume net investment growth of 7% per annum, the position if they encashed their investments in full after eight years would be as follows:

| Scenario A | Scenario B |

| Retain ISAs and invest the equity into collective funds | Invest in an EU Portuguese qualifying Investment Bond |

| 28% tax on the growth annually | Nil tax on annual growth if policy not surrendered |

| Tax after eight years: 11.20% on full encashment | |

| Value = £1,481,964 | Value =£1,638,381 |

Furthermore, if Peter and Jane didn’t encash the whole bond, preferring to take annual withdrawals to supplement their income, 11.20% tax would only be applied proportionately on the investment gain. This means they would pay considerably less tax than if they invested in collective funds and retained their ISAs.

Although the principle of paying tax applies to everyone, we can choose how much we pay and exercise our right to reduce it to the legal minimum.

Who wouldn’t choose to pay 11.20% tax on proportionate gains, only when they are withdrawn, rather than 28% on the whole gain every year?

If you would like to find out more about tax-efficient investments in Portugal, please contact us below.